Marketforce: Digitizing Africa's Informal Retailers

Ecommerce and Software for Africa's Informal Retailers

Small corner stores are a defining part of emerging market economies. These stores sell everything from groceries to mobile phone data and medicines. In Africa, these retail corner stores are ubiquitous and in 2016 they (and other informal retailers like street hawkers) accounted for approximately 90% of retail sales across Africa. The promise and potential of digitizing these retail stores has attracted some of the sharpest entrepreneurs globally and billions of dollars in venture capital. In Africa, one of the biggest startups in this segment is Kenyan startup MarketForce.

MarketForce is an operating system for end-to-end retail distribution in Africa. It offers a unified B2B ecommerce marketplace to facilitate product sourcing for informal merchants and faster and more efficient distribution for leading consumer brands such as Pepsi, Safaricom, Fort Beverages and others. The company was founded in late 2018 by Tesh Mbaabu and Mesongo Sibuti and is headquartered in Nairobi, Kenya. It is backed by Y Combinator,, SOSV, V8 Capital Partners and Africa’s Business Heroes.

Since its launch in 2018, Marketforce has managed to:

Raise $43M in funds

Acquire 200K+ merchants and 50 FMCG brands on the platform

Complete 300K transactions worth more than $500M

Launch operations in Kenya, Nigeria, Uganda, Tanzania, Rwanda and Ghana.

Product

MarketForce has built an end-to-end operating system for retail distribution in the six markets it operates in. Today the company has two main products: RejaReja and MarketForce One.

RejaReja

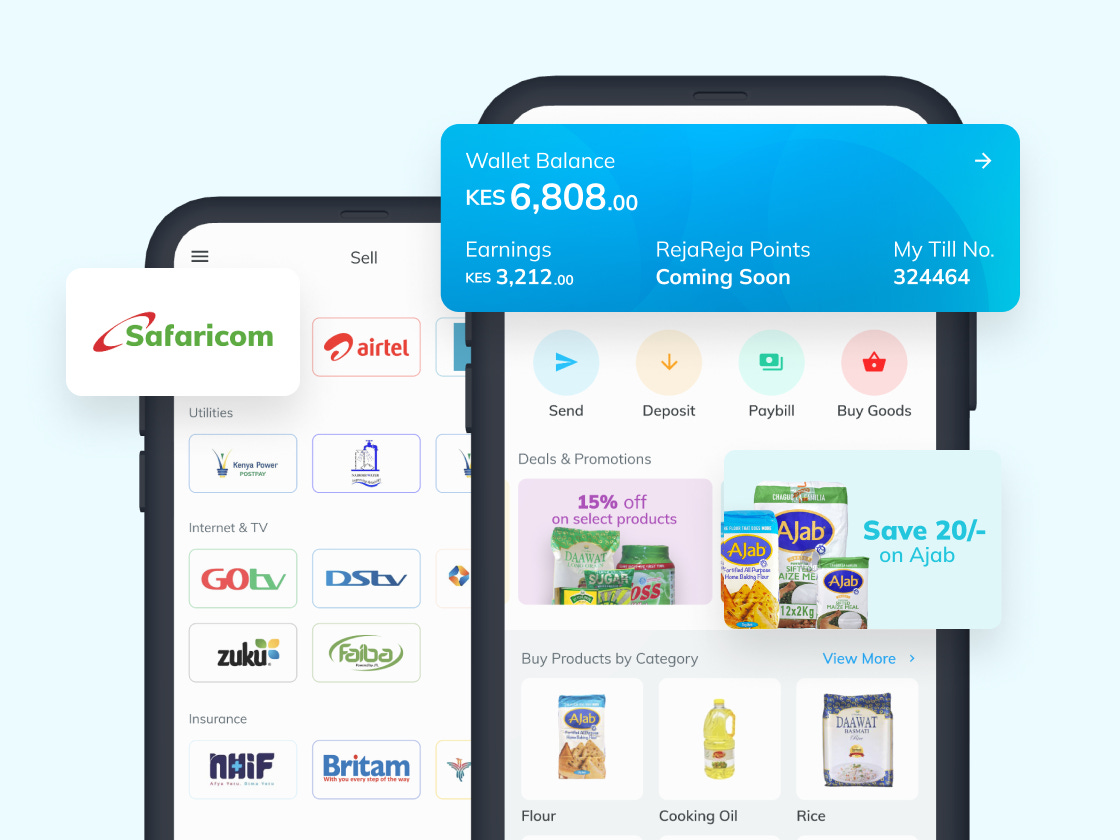

RejaReja - which means “retail” in Swahili - is MarketForce’s Super App for merchants. The app is a full ecosystem of services for informal merchants and enables them to source, order and pay for inventory digitally, access financing, collect digital payments and make extra money by reselling digital financial services such as airtime, electricity tokens and bill payments.

Through RejaReja informal merchants can access and easily procure inventory across a vast assortment of SKUs from leading FMCG brands with next-day delivery. This solves two problems across the retail supply-chain. Firstly for retailers it makes the process of procuring inventory faster and easier by centralizing their purchases into one single place and offering them next-day delivery. Meanwhile for FMCG brands RejaReja offers them the ability to extend their distribution network into areas where they don’t have a presence as well as offers them richer data on purchase behaviour across informal retailers. Unlike some other startups in this category RejaReja is an asset-light model. MarketForce doesn’t own warehouses and delivery trucks. Instead it relies on its network of partners which includes manufacturers and distributors to handle the storage and delivery of different SKUs.

In addition to enabling informal retailers to source goods, RejaReja also enables them to easily sell digital services. This is something that is unique to emerging markets where these informal retailers play an important role in their community and often serve as a bridge to digital services and financial services for their community. For example, in recent years in emerging markets a new phenomenon has emerged of “agency banking” where many of these informal retailers are authorized to act as agents for banks and serve basically as a bank branch in smaller cities and towns.

RejaReja offers retailers the tools to sell digital services such as airtime as well as to enable bill payments, enabling these retailers to participate in the physical as well as digital economy for the first time. This approach to enable physical as well as digital sales has been pursued by startups in other markets such as Indonesian unicorn Lummo.

MarketForce One

MarketForce One is a tool built to help financial institutions in Africa reach more potential customers by giving them streamlined access to MarketForce’s network of retailers and by creating workflow tools to make their sales processes more efficient. MarketForce One helps these sales teams with efficient route mapping, customer geolocation, sales forecasting and reporting, realtime quotations and other tools to make their workflows more efficient.

Market

Despite hundreds of billions of dollars of consumer goods being sold annually through informal channels, the African retail industry continues to be highly fragmented. Kiosks and informal retailers historically struggle to procure inventory from suppliers regularly and in a timely manner. Even more importantly these retailers struggle with access to capital, with MSMEs notoriously facing a $5 trillion credit gap in Africa. These two problems combine to put informal retailers in a bind and make it difficult for them to grow their business.

Consumer spending in Africa is forecast to cross $2.5 trillion by 2030 powered by increasing per capita income and a growing population.

Competition

The B2B ecommerce market has become one of the most popular categories for startups globally over the past few years. The category has attracted numerous players in Africa including the likes of Wasoko, TradeDepot, Alerzo, Chari and Sabi.

Wasoko was founded in 2016 and is also headquartered in Nairobi, Kenya. The company aims to improve product sourcing for informal retailers. These retailers can easily order goods via SMS or mobile apps with free same-day delivery. The company was founded by Daniel Yu, David Jaress and Josh Raine and has grown revenue 1,000% since 2019. It is processing $300M in GMV across 150,000+ monthly orders and has delivered 2.5M orders to 50,000+ active retail customers in its network. To date, it has raised $143M in funding.

Like MarketForce, TradeDepot is a B2B ecommerce and embedded finance platform that offers a variety of consumer goods to SME retailers. Its end-to-end distribution platform connects informal African retailers directly to some of the world's top consumer goods companies, leveraging technology to improve the distribution process. The company was founded in 2016 by Michael Ukpong, Onyekachi Izukanne and Ruke Awaritefe, and is headquartered in Lagos, Nigeria. Since inception, it has managed to grow its GMV significantly and is currently servicing 100,000+ merchants through its platform. The company has raised $123M in funding.

Alerzo is a B2B ecommerce retail company founded in 2019 that empowers informal retail stores through on-demand inventory distribution and financial services. It also provides real-time market trends, customer feedback and other consumer purchasing data to brands and manufacturers. Founded by Adewale Opaleye the company has headquarters in Ibadan, Nigeria and has managed to raise $16M in funding to date. It has a network of 100,000+ small businesses, 90% of which are women-led. It exclusively serves tier-2 to tier-4 cities in Southwest Nigeria such as Ibadan, Ekiti, Abeokuta and more.

Chari is an ecommerce and fintech app that allows traditional retailers in French-Speaking Africa to order consumer goods and get delivered for free in less than 24 hours. It also offers microloans to these retailers. Founded in 2020 by Ismael Belkhayat and Sophia Alj, it is headquartered in Casablanca, Morocco. The company has raised $7.4M in funding and is valued at $100M. It currently has a network of 50,000 merchants, transacts about $2.5M monthly and is growing 20% month-on-month.

Founded in 2020 Sabi provides digital infrastructure for the distribution of goods and services across retail supply-chains. Its platform provides agents, merchants, distributors and manufacturers access to inventory, commodities, logistics, business tools, data insights and financial services. It also offers them technology rails that can help them grow their businesses. The company was founded in 2020 by Ademola Adesina and Anu Adasolum, and is headquartered in Lagos, Nigeria. It registered an average monthly growth of 40% in Nigeria, processes nearly $12M in monthly GMV and serves 250,000 merchants through its platform. The company has raised $28M in funding to date.

Growth Opportunities

Broadly speaking the B2B ecommerce market has proven to be a challenging category for startups to grow sustainably in. Many of the players globally have used aggressive discounts and subsidies to acquire market share of retailers and grow their sales. However, informal retailers have shown a tendency not to be loyal to any specific platform but to order from the player offering the lowest prices in the market for any given good.

The original thesis for startups seeking to disrupt B2B ecommerce was that by applying technology and economies of scale to the category these companies would be able to expand gross margins. However, this thesis broadly remains unproven globally as the huge salary costs these startups have for in-house developers and product managers has significantly increased their fixed costs in comparison to legacy, non-tech enabled distributors.

Moving forward MarketForce has two main potential growth strategies it can pursue:

Geographical expansion

Doubling Down on MarketForce One

The most straightforward growth path for MarketForce is to continue its geographical expansion. However launching new geographies is a huge investment of resources and competition in all major African markets is intense. The only major market MarketForce is not currently present in is Egypt. However, the Egyptian market is highly competitive and exposes the company to a new set of competitors including Maxab and Cartona. At this stage, with the VC market tightening and availability of capital decreasing (especially for emerging markets startups) further geographical expansion is not the best growth path. Instead, MarketForce should focus on capturing market share and dominating the existing geographies it is present in.

The second potential growth path for the company is to double down on MarketForce One and broaden the product suite. Across Africa informal retailers are serviced by existing supply-chains and distributors. While these supply-chains are inefficient and have numerous issues, they do work well enough to keep goods flowing. The opportunity to offer better software and tools to the entire supply-chain is enormous. MarketForce One is the company’s first product dabbling in this space but the needs are huge.

By offering distributors, manufacturers and retailers solutions that can digitize their business MarketForce can solve a major gap in the market - data. Because most of these supply-chains are manual the lack of data visibility is significant. Similarly, by digitizing these supply-chains MarketForce can drive efficiency across the entire supply-chain. In 2021 MarketForce partnered with Cellulant, a Pan-African payments company to help it expand into new markets. Partnerships like these to ease the acceptance of digital payments could also be a key feature for MarketForce One.

This growth path is far less capital-intensive than building new warehouses and expanding into new cities and geographies. Similarly by charging a transactional fee or SAAS fees MarketForce could also benefit from a bump to its valuation multiples as software / fintech businesses are valued more highly than lower margin ecommerce businesses.

Overall MarketForce has built a substantial multi-geography business in the B2B ecommerce category. Unlike many other players in the market the company has also experimented with building digital products for different players in these supply-chains. However competition in this segment is intense across the continent and there are several well capitalized players vying for dominance. Over the next few years consolidation is likely in this segment across the continent and MarketForce has positioned itself to be one of the leading players in this category.