Lummo: Asia's Merchant Operating System

Digitizing SMBs in Indonesia

Small and medium-sized businesses (SMBs) are the engine of economies around the world. SMBs come in all shapes and sizes from mom-and-pop stores to businesses with dozens of employees and multiple locations. Globally startups have zeroed in on SMBs, particularly small merchants and retail stores as a rich segment to target to roll out technology products for. While this phenomena is global, one of the first countries that has seen entrepreneurs try digitize these small retailers is Indonesia.

One of the startups leading this charge is Lummo (recently rebranded from BukuKas). Lummo is building Asia’s merchant operating system and offers a range of accounting, financial service and ecommerce tools to Indonesia’s gigantic market of SMBs. Lummo was founded in 2019 and since then has scaled extremely rapidly:

6+ million users and 3+ million monthly active

$150 million raised from the likes of Sequoia Capital, Tiger Global and CapitalG

$25B+ in annualized bookkeeping volume

1+ million merchants using LummoShop

Products

Lummo is laser focused on building tools to help SMBs grow and operate their businesses more efficiently. The company has two core product offerings for customers today:

BukuKas: A SMB accounting solution with a suite of tools to help SMBs run their internal finances

LummoShop: Tools to enable retailers to setup online stores and start selling online

BukuKas offers SMBs a range of tools to help digitize and automate many of their daily financial tasks including transaction records, invoice generation tools, receivable collections via Whatsapp or SMS, business dashboards and much more. BukuKas is designed to be used on mobile allowing it to serve any SMB owner or employee with a smartphone. A key feature of BukuKas is BukuKasPay - its payments tools for merchants which it launched late in early 2021. BukuKasPay crossed over $1.3 billion in annualized payment volume across 150,000 merchants by October of 2021.

Lummo began to experiment with ecommerce enablement during the pandemic as the lockdowns presented life-threatening challenges to many of its SMB customers who relied on in-person traffic and transactions. This experimentation initially took the form of simple, easy-to-setup ecommerce stores for these retailers which the company called Tokko. However, after seeing early success with Tokko, Lummo doubled down and invested heavily in broadening its ecommerce enablement tools and renamed its ecommerce set of tools LummoShop. LummoShop saw huge adoption in 2021 with over 1 million merchants using the product that year.

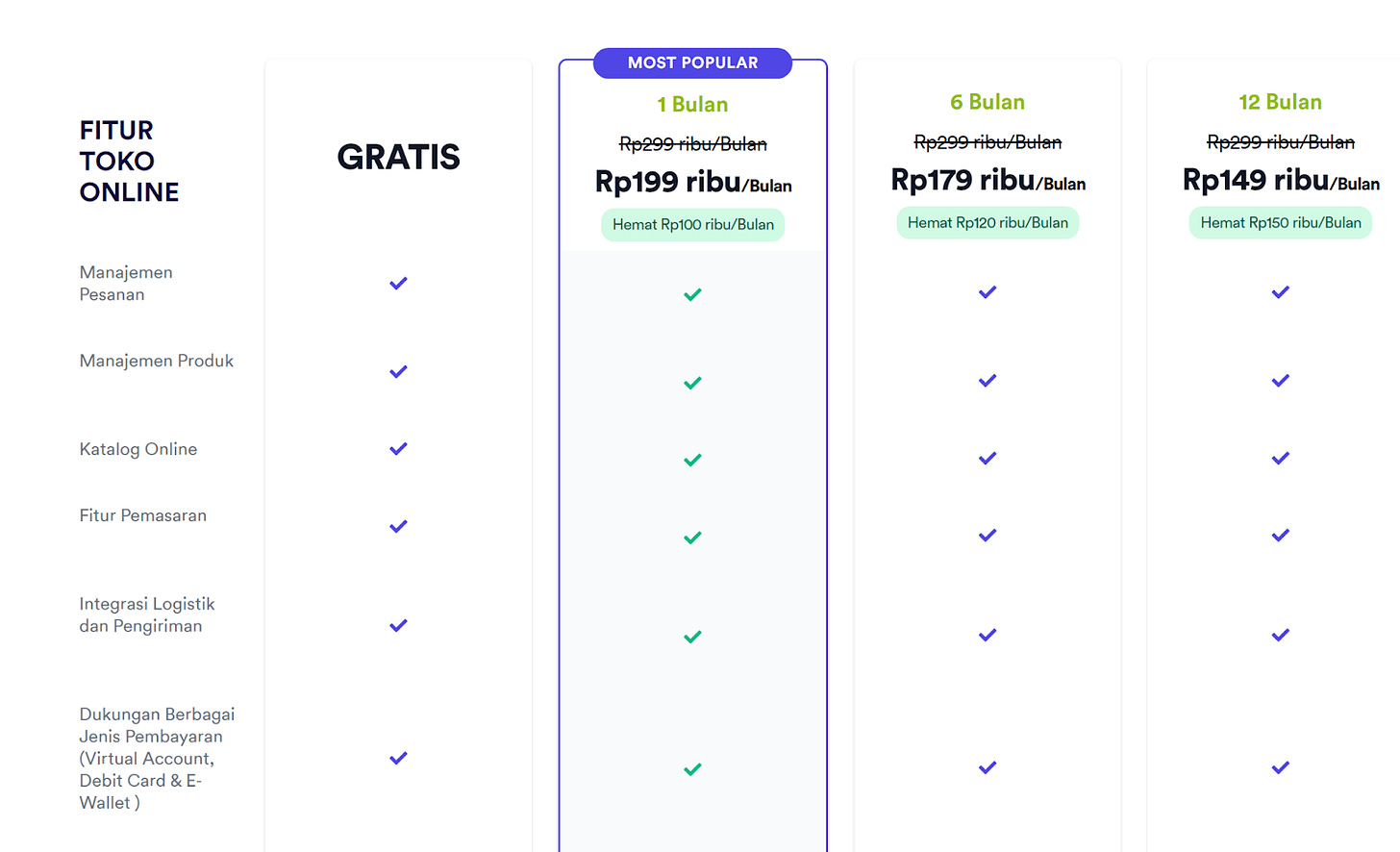

LummoShop offers many of the standard tools and functionalities offered by other ecommerce platforms globally including online product catalogs, order management, integrations with logistics partners and marketing tools.

Market & Competition

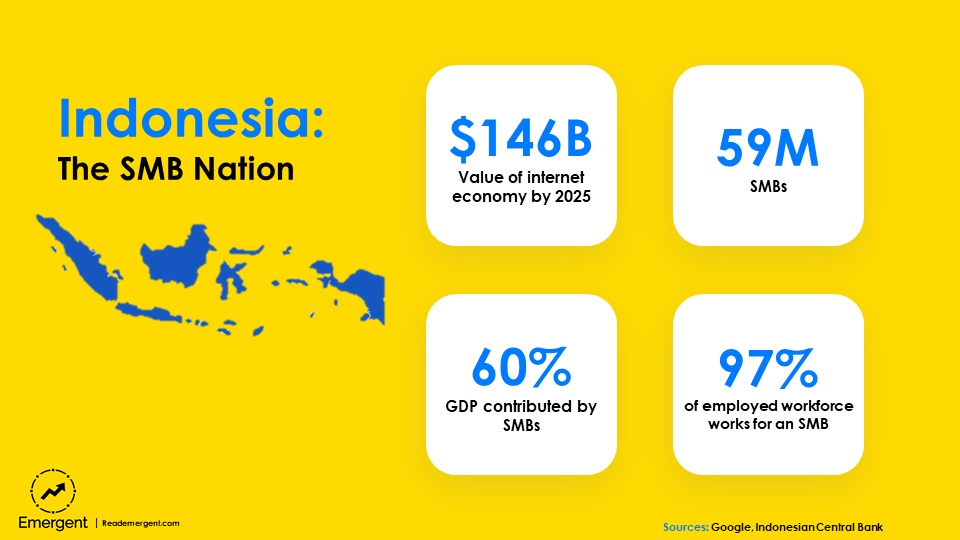

Indonesia is one of the largest and most promising markets for startups targeting SMBs. Indonesia has 59 million SMBs today that account for 60% of Indonesia GDP and employ an incredible 97% of the country’s workforce. In contrast, the United States - a country with 70 million more people than Indonesia - has 30 million SMBs that employ 60 million people. Indonesia’s enormous number of SMBs provide a rich opportunity to deploy new technology products at scale.

Indonesia’s merchants are digitizing quickly - thanks in large part to the digital acceleration kicked off by the COVID-19 pandemic. In fact 28% of Indonesian merchants surveyed in Google’s recent E–conomy SEA 2021 report state that they would not have survived the pandemic if not for the digital tools they adopted. The new behaviors triggered by the pandemic look set to stay in place and in most cases grow over time. Across multiple digital products a significant minority of merchants report plans to increase their usage of these digital tools over time.

The race to become the dominant technology player serving Indonesia’s SMBs has become a two-horse race in the past 12 months between Lummo and competitor BukuWarung, both of whom have raised a significant amount of venture capital funding and have millions of users on each of their platforms.

Lummo’s recent expansion into ecommerce enablement through LummoShop gives it a significantly differentiated value proposition compared to BukuWarung which so far has remained focused on its core accounting and financial service automation tools. Lummo can now help customers both sell online and grow revenues through LummoShop and automate internal financial processes through BukuKas. This gives Lummo a favorable competitive position in the market vis-a-vis BukuWarung going into 2022.

Growth Opportunities

While Lummo has grown incredibly rapidly since its inception in 2019 it has just scratched the surface of the opportunity in serving SMB customers in Indonesia. Lummo has two possible growth vectors worth pursuing in the years ahead:

Geographic expansion

Evolve into a comprehensive business banking platform

Lummo has already publicly stated plans to expand across Southeast Asia with Vietnam, Thailand and the Philippines already being studied by the company as potential near-term markets to launch in. Southeast Asia’s 600 million people present an enormous opportunity with the internet economy of the region forecast to cross $1 trillion in value by 2030. Geographic expansion is a must for Lummo to truly capture the potential of Southeast Asia’s SMB economy.

Besides geographic expansion, Lummo has a compelling opportunity to evolve into a business banking platform for Southeast Asia’s SMBs. SMBs are typically highly underserved by banks and struggle to get access to credit - a crucial enabler for running and scaling a successful business. In Southeast Asia 33% of SMBs lack access to credit and this is likely an underestimate of the severity of the problem. Temasek estimates that digital lending will be a $110 billion opportunity in Southeast Asia by 2025.

Lummo’s has a 360 view of its customers' businesses that is unmatched in the region and by equivalent businesses in much of the world. Lummo has the benefit of a deep view into the accounting and financial health of its customers via BukuKas as well as deep insight into its customers online sales, growth rate and marketing expenses via LummoShop. This will enable Lummo to underwrite loans using data that many other lending fintechs in Southeast will struggle to access. Similarly the combination of BukuKas and LummoShop allows the company to offer loans that are structured in unique ways. For example, the company can offer a customer a loan to spend on digital marketing to increase sales on its ecommerce store and automatically deduct a share of profits of every sale including in-person sales (tracked via BukuKas) to repay the loan. This is highly differentiated in the world of lending where typically ecommerce enablement and fintech startups are two distinct categories.

Lummo is perfectly positioned to become the dominant player serving Indonesia’s SMBs and potentially Southeast Asia’s. The region is enjoying significant, secular long-time growth and the large share of GDP accounted for by SMBs make them an appealing target for tech companies to digitize. If Lummo evolves to become a full-service business bank offering credit, loans, payroll services and the like it will be able to capture a market ignored by most traditional banks and become the most valuable and powerful partner for SMBs across the region.