Growsari: Digitizing Sari-Sari Stores in the Philippines

A rising B2B Commerce star in Southeast Asia

In the Philippines, small neighborhood convenience shops called Sari-Sari stores are far more common than supermarkets and large retailers across the country. They are a core part of the Philippines' retail ecosystem with the 1.1 million Sari-Sari stores nationwide driving 60% of all FMCG sales in the country. They are usually operated from home by a family as a source of livelihood, and offer everyday necessities to the local community. Family members take turns to replenish inventory from local supermarkets, which means that despite their importance, sari-sari stores operate with limited technology and efficiency.

In 2016, Growsari was launched as a B2B tech-enabled platform helping these Sari-Sari stores transform their business from simple FMCG outlets to comprehensive service hubs. The company provides these stores with the required infrastructure and digital tools and enhances their efficiency through a wide range of products and value-added services. Beside Sari-Sari stores, it also services roadside and market shops called carinderia as well as pharmacies.

Growsari was founded in 2016 by Andrzej Ogonowski, ER Rollan, Shiv Choudhury, and Siddhartha Kongara and is headquartered in Manila. The company is backed by investors like Tencent, KKR, Wavemaker Partners, IFC and Endeavor Catalyst.

Since inception, Growsari has grown across multiple fronts:

Has raised $110 million in total funding

Operates in 400+ municipalities and 20 key cities in Philippines

Has 150,000 MSMEs active on its platform

Created a network of 200+ service providers

Product

Growsari has built a comprehensive ecosystem of products to service Sari-Sari stores in the Philippines and enable their growth. These products include:

Growsari App: Through the app store owners can access a wide assortment of over 800+ FMCG products at competitive prices as well as other everyday products such as rice, sugar and flour. The orders are delivered straight to the stores, and come from suppliers like Unilever, P&G, Alaska, Nestle, and many more. This mobile app and logistics service enables Sari-Sari stores to digitize their inventory procurement, saving significant amounts of time and increasing their profit margins.

Digital services: Similar to regional player Lummo, GrowSari enables Sari-Sari stores to offer multiple digital services for the first-time such as recharging your phone plan and bill payments. Growsari also enables sari-sari stores to serve as online shopping ordering hubs for their communities for two of Southeast Asia’s main ecommerce platforms Lazada and Shopee.

SariPay: offers working capital loans, cash management, remittances and other financial products to Sari-Sari stores. SariPay is recent spinout from Growsari that will be operated as an independent company.

Growsari enables Sari-Sari stores to replenish their stocks with affordable on-demand inventory that can be sourced online and delivered straight to their homes free of charge. Store owners are given direct access to products at competitive prices, which helps them scale their business sustainably over the long run. Impressively, Growsari has managed to attract major local partners to invest in the company, such as Robinsons Retail Holdings which is one of the largest retailers in the Philippines. Some of Robinsons supermarkets act as Growsari’s fulfillment hubs.

Lastly Growsari also provides Sari-Sari stores with features like pricing tools, inventory management and working capital loans to grow their business. For manufacturers and distributors, Growsari’s platform generates crucial data & insights into the operations of these stores to help them create their strategies and campaigns.

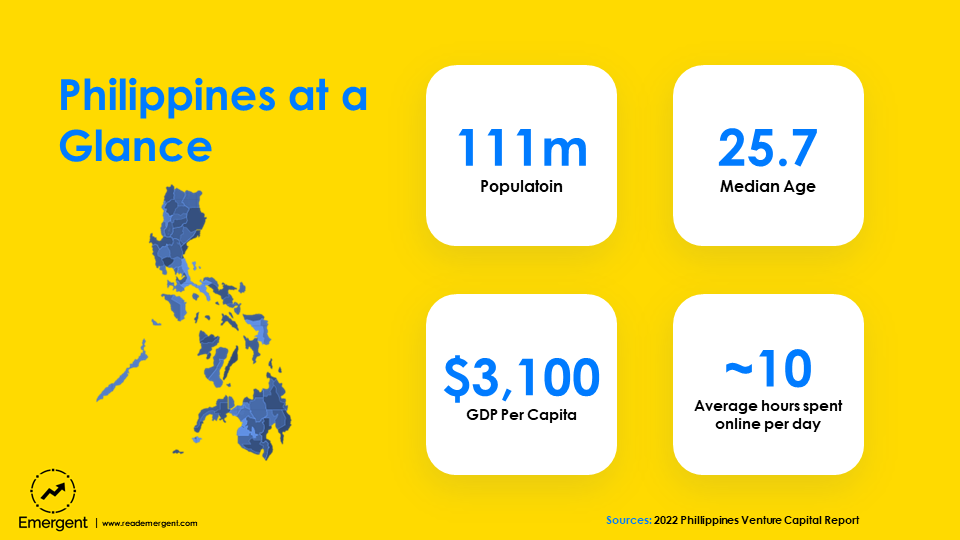

Market

The presence of Sari Sari stores on street corners nationwide has cemented their role as a key pillar of the Philippines retail ecosystem. These stores are crucial pillars to both the economy and communities across the country. In fact, Sari-Sari stores make up over 90% of MSMEs in the Philippines. Unfortunately with the arrival of the pandemic, the Filipino retail sector took a huge hit due to lockdowns and physical distancing measures. Even the sari-sari stores were not spared, as the pandemic forced over 1 million of them to close their storefronts. Total retail sales in the Philippines are forecast to reach $68 billion by 2026 up from $53 billion in 2021. The growth of retail sales is powered first and foremost by the country’s high and steady GDP growth rate of between 4 - 7% annually almost every year since 2000.

Competition

The Philippines has long been an overlooked market for startups across Southeast Asia who have often focused on launching into Indonesia given the country’s huge population and market. Given that, Growsari is lucky to face limited competition from other B2B commerce startups today. Instead, the company faces one direct competitor Bukalapak and a few indirect regional competitors that likely aspire to expand into the Philippines over time. These competitors include BukuWarung, Ula, Gudangada, and BukuKas.

Bukalapak is an Indonesian ecommerce platform that enables small businesses to sell online as well as offer services to help digitize these small neighborhood stores. The company was founded in 2010, raised over $900 million in funding and listed publicly on the Indonesian stock exchange in 2021. The company recently entered the Philippines and launched its SmartSari product into the market. Unlike Growsari, SmartSari doesn’t offer Sari-Sari stores the ability to procure inventory. Instead SmartSari exclusively enables these stores to sell digital products such as phone credits and game credits. In the near term the company plans to launch bill payments, grocery shopping and other related services. The company is well capitalized and thank to being public has the ability to raise large amounts of financing at its discretion.

Ula is a B2B commerce startup that provides working capital and access to inventory for small stores across Indonesia (known locally as “Warungs”). The company was founded in 2020 and in the short time since then has managed to raise $140 million in funding from the likes of Tiger Global, Sequoia Capital India, Tencent and Bezos Expeditions. Ula has over 10,000 SKUs on its marketplace and has acquired over 200,000 stores in Indonesia to date. While the company has significant room to grow in Indonesia, over the longer-term geographical expansion across Southeast Asia is likely part of their plans.

Gudangada is a B2B commerce startup that helps digitize procurement for Warungs across Indonesia as well as provides Indonesian good distributors digital tools to improve their business. The company was founded in 2019 and since then has raised over $130 million in financing from the likes of Sequoia Capital India and Wavemaker Partners. The company primarily offers these Warungs a digital platform to handle their inventory procurement as well as handles delivery of the goods. However, the company has recently expanded into fintech and is building both a point-of-sale solution as well as lending products to better serve its Warungs.

Bukuwarung is an indirect competitor focused on building bookkeeping, digital payments and ecommerce solutions for MSMEs in Indonesia. Based out of Jakarta, it enables MSMEs to manage and grow their businesses. The startup was founded in 2019 with a vision to empower 60 million MSMEs in Indonesia to become financially aware and leverage technology for growth. The company has raised $80 million since inception and it is estimated to be valued around $250M. To date, it has 6.5+ million registered merchants on its platform in 750 Indonesian cities, and has processed about $1.4 Billion in annualized payments so far.

Another indirect competitor is Indonesian startup Lummo (see our breakdown of the business here). Lummo offers MSMEs tools for inventory management, digital ledgers and payments through its subsidiary BukuKas as well as tools to sell online through LummoShop. The company was founded in 2019 by Krishnan Menon (see our interview with him here) and Lorenzo Peracchione and is also headquartered in Jakarta. Lummo was founded in 2019 and since then has raised around $150 million in financing. The company has over 1 million merchants on its platform and is processing billions of dollars of payment volumes.

Growth Opportunities

Growsari has plenty of room to grow within the Philippines and has acquired around 15% of the Sari-Sari stores in the country to date. Aside from simply acquiring more Sari-Sari stores which will happen as a function of time and effort there are several other growth paths the company can pursue including:

Expanding its suite of fintech products

Creating new products and tools for CPG companies and distributors

In 2022, after Growsari raised a $77.5M Series C round, it stated plans to expand its fintech offerings for sari-sari store owners. A common pattern across emerging markets is for SMEs to find it nearly impossible to secure credit from lenders. Sari-Sari stores are no exception and they lack access to working capital and capital to finance growth. In addition, as payments continue to digitize in the Philippines these stores will need access to a range of tools to facilitate digital payments from QR codes to point-of-sale terminals. Growsari is using the expertise of its investors as it branches into fintech. For example, the company is working with its investor IFC to help it develop an accurate credit scoring model to enable it to lend to its customers effectively. The spin out of SariPay is a clear sign that fintech is a major priority for the company moving forward.

Besides Sari-Sari stores there is a significant opportunity for Growsari to build data products and digital tools for CPG companies and distributors across the Philippines. These companies lack the capability to build digital products in-house and international solutions to many of their needs don’t fit local requirements. Growsari’s access to detailed procurement data and consumption patterns is particularly valuable to both segments. Similarly, there is likely significant room for improvement in how these companies manage their logistics, a place where technology can make a huge difference.

Overall Growsari has built a strong lead in the Philippines market and become a major technology player in the country’s retail ecosystem. By focusing on the Philippines and falling to the temptation to expand into Indonesia the company has managed to avoid the intense competition other regional players face. The Philippines will continue its steady growth in the years to come and will continue to digitize. Growsari is positioned to become one of the Philippines first and biggest tech success stories.

where can we find the procedure on the deactivation of account