Flutterwave: Championing Digital Payments in Africa

My name is Mikal – I’m an early-stage tech investor and I was born in Asia, grew up in Africa and now live in the US. Every week I break down a fast-growing business in an emerging market to understand its product, market and growth strategy.

This week I’m breaking down African B2B payments startup Flutterwave

The digitization of payments is a lucrative opportunity that entrepreneurs across the world are chasing after. In Africa, where a large percentage of the population remains unbanked and the penetration of credit and debit cards low, this opportunity is particularly large. The soaring number of smartphone users on the continent combined with growing pressure to adopt new technologies has created a special moment for fintech in Africa. Numerous companies are working on digitizing payments in Africa but one of the most prominent companies working on this challenge is Nigerian fintech Flutterwave.

Flutterwave is a financial technology company providing payment solutions, invoicing solutions and ecommerce capabilities to merchants in Africa, helping them digitize the full-cycle of payments. Flutterwave was founded in 2016 and since then has grown rapidly:

$9 billion in transactions processed to date

Operating in 11 core African markets but available in over 30 countries

Enabling payments in over 150 currencies

300+ employees

$234m raised to date

Valued at $1 billion

Products

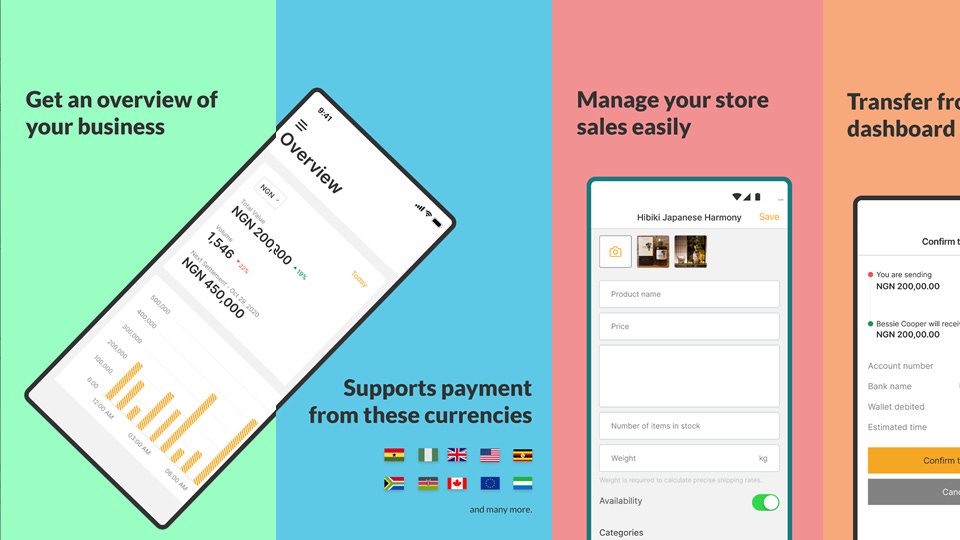

Today, Flutterwave is one of Nigeria and Africa’s most exciting fintech businesses. Flutterwave offers a range of interrelated products including:

Flutterwave Checkout: Empowering merchants to use their mobile phones to accept payments

Virtual Card API: Enabling the creation of virtual credit cards instantly

Flutterwave Store: A Shopify like service for selling products online

Barter by Flutterwave: Peer-to-peer payments product

Invoices: Invoice solutions for merchants

Payment Links: Send link for one-time payment, recurring and donations

Market

Africa’s population is set to more than double from 1 billion today to 2.5 billion by 2050, making it a rich hunting ground for fintech businesses to target. Today, the top five largest economies on the continent are Nigeria, Egypt, South Africa, Algeria and Morocco. Flutterwave is currently active in two of these five (Nigeria, South Africa) with its eyes on expanding into the other three in the near future.

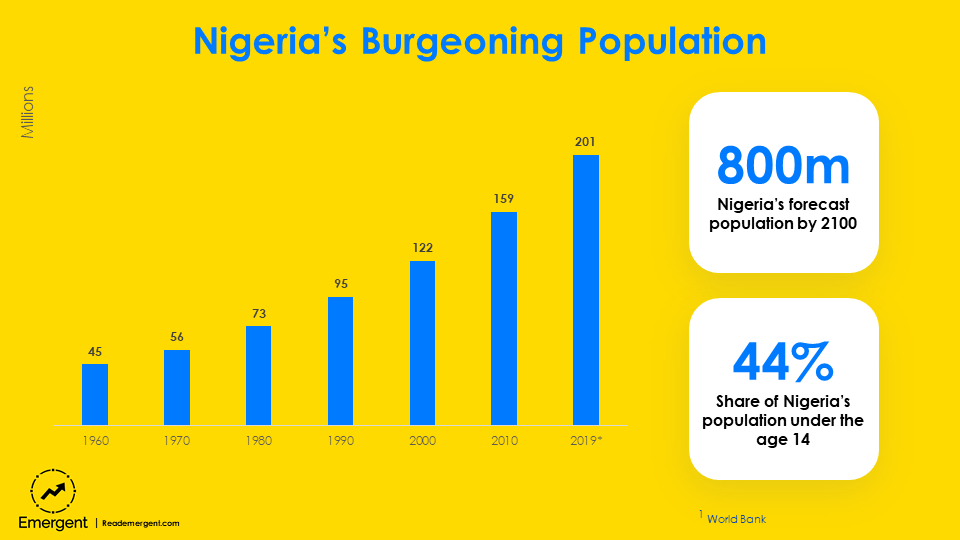

Of all the countries in Africa, Nigeria is the most compelling opportunity for any new startup business. Nigeria’s population has ballooned from just under 50 million in 1960 to 200 million as of 2019. A massive 44% of Nigeria’s population today is under the age of 14 and growing up in a digitally-native environment thanks to the spread of affordable smartphones across the world. Incredibly however, Nigeria’s population growth story is far from over. Nigeria’s population is forecast to cross 800 million by 2100, 4x larger than its population today.

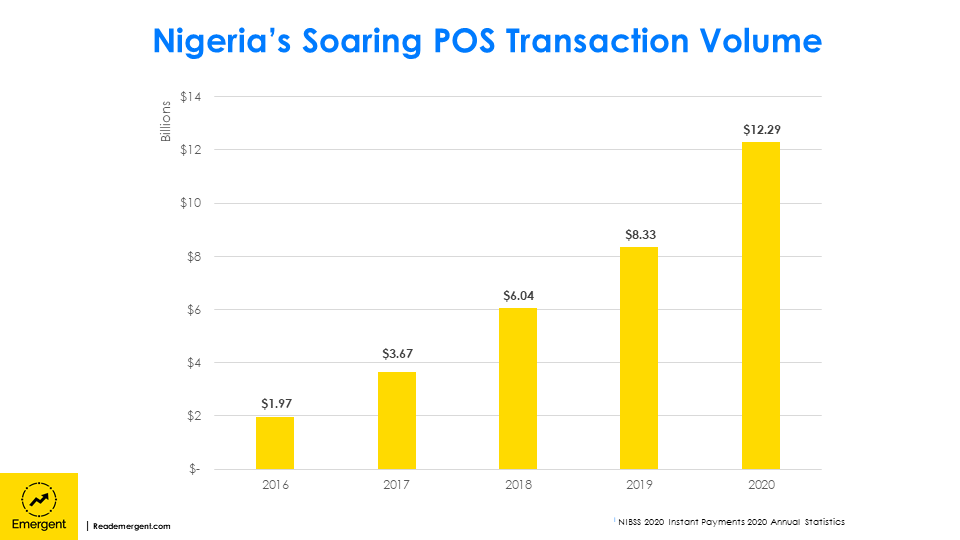

Today, the momentum behind digitizing payments in Nigeria is continuing to accelerate, which is only helping Flutterwave’s business. The volume of digital payments in Nigeria have grown at a compound annual growth rate (CAGR) of 144% over the past five years, crossing $12 billion in 2020.

Competition

The lucrative opportunity to digitize payments in Africa has attracted the attention and efforts of a broad range of companies. Legacy banks for example across the continent continue to invest in acquiring new customers, offering digital accounts and credit and debit cards to their target markets.

However, Flutterwave’s direct competitors are mostly other fintech startups aiming to solve similar problems to Flutterwave. These competitors include:

Paystack: Providing payments solution in Africa and recently acquired for $200m by American fintech giant Stripe

Fawry: Publicly-listed company ($2B market cap) providing payments solutions for the Egyptian market. Processed $5 billion in payments in 2020.

VoguePay: A Nigerian payments company with 100,000 merchants and has processed over $100m in payments to date.

Interswitch: Nigerian fintech business with 190,000 active merchants and valued at over $1 billion.

Interswitch is one of Nigeria’s most notable fintech businesses and is the market leader in Nigeria today. As recently as 2019, over 90% of electronic transactions in Nigeria were processed by Interswitch according to Moody’s. Interswitch’s product depth is far greater than Flutterwave and it has over 190,000 businesses on its platform transacting daily and has over 22 million credit cards on its Verve network. Interswitch has been more focused on increasing market share in a few markets than expanding geographically. Besides Nigeria it is also active in Gambia, Kenya and Uganda.

Each of Flutterwave’s competitors compete with it in a range of different markets. Fawry for example has an early advantage in the Egyptian market - Africa’s second largest economy. In addition, by virtue of being publicly traded it has access to cheaper capital to finance further growth and expansion. In 2020 Fawry processed $5 billion worth of payments, almost half the amount of payments Flutterwave has processed in its entire life cycle. Fawry is also profitable and generated $11m in net profit in 2020, which it can reinvest into growth sustainably.

Lastly, Paystack is potentially Flutterwave’s most significant competitor over time. Paystack is very similar to Flutterwave and offers payment solutions, invoice products and the ability to accept payments in numerous currencies and numerous formats. In 2020, Paystack was acquired by American fintech giant Stripe. The addition of Stripe’s scale, engineering strength and know-how makes Paystack a far more significant competitor to Flutterwave.

Growth Opportunities

Africa is a continent on a long-term growth path population-wise and economically. This rising tide may very well lift all boats and as developed markets have shown there is room for multiple financial institutions at every level (banks, payment processors, credit unions etc). That being said, what strategies can Flutterwave pursue to continue to grow its payments processed and market share?

Flutterwave has three potential approaches it can pursue to grow:

Further geographical expansion

Expand its ecommerce capabilities

Expand its suite of fintech services

Flutterwave is already pursuing strategy one and in its most recent $170 million round of fundraising it made clear that part of the proceeds will go towards expanding into Egypt and Northern Africa, where 3 of Africa’s 5 largest economies are located. Given the continent is made up of over 54 countries there is ample opportunity to continue to expand across each of them over the next decade. However, geographic expansion may come at the expense of growing market share in the 11 core markets Flutterwave is active in today, something the company needs to balance carefully.

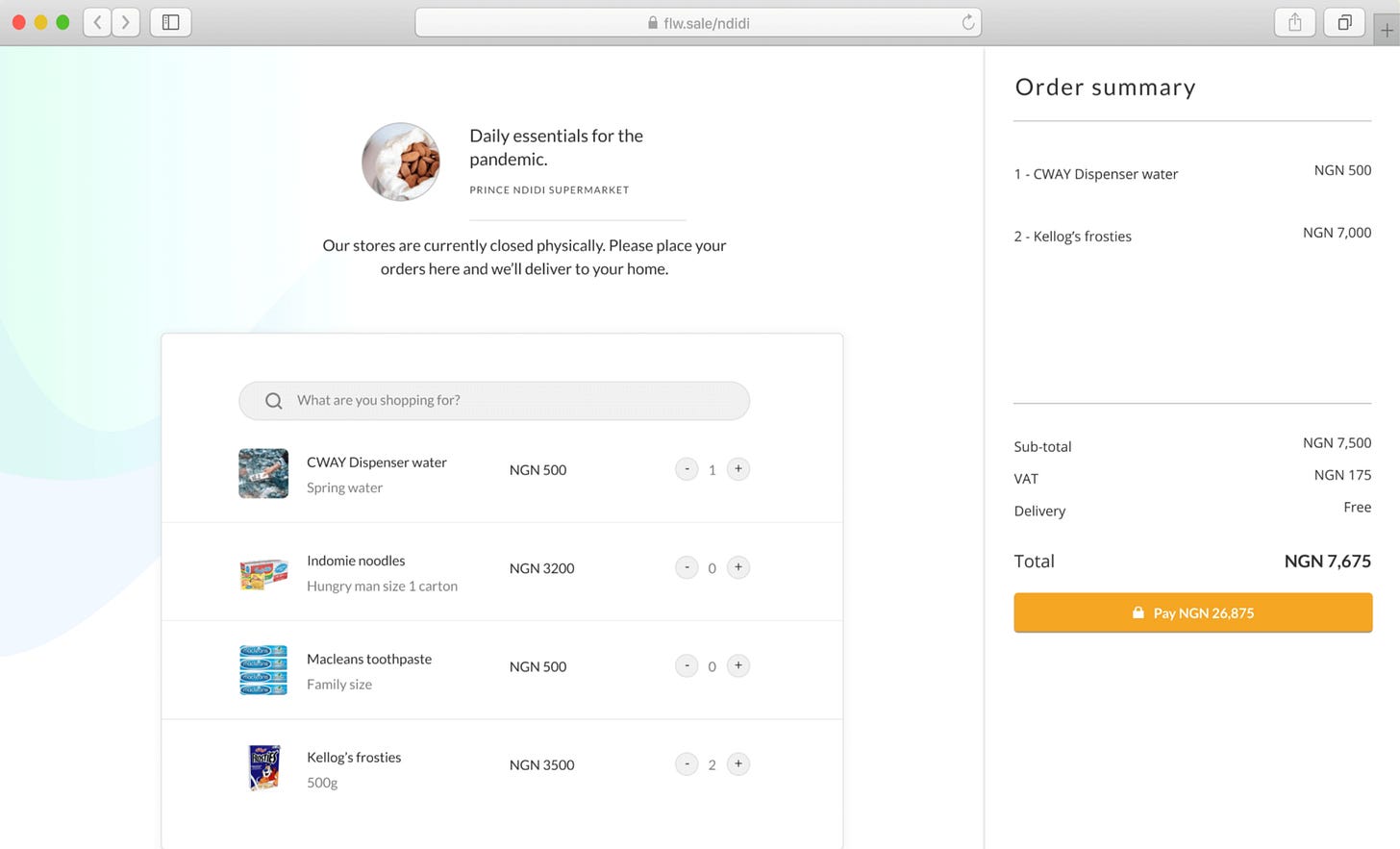

In early 2020 as the full extent of the COVID-19 pandemic became apparent, Flutterwave quickly launched its store product allowing merchants to showcase their products online and link up payment options. Flutterwave Store is integrated with third-party logistics services like Sendy in Kenya and Sendbox in Nigeria to facilitate delivery. When news broke of the launch of Flutterwave Store the company’s CEO Olugbenga Agboola was clear and adamant that it did not represent a pivot for the business and it has no aspirations to become a competitor with Jumia - Africa’s leading ecommerce platform.

Despite this, deepening investment into Flutterwave Store so that its product functionality starts to resemble much of what Shopify offers is a lucrative opportunity for Flutterwave and a logical extension of the B2B payments platform it has built today. Ecommerce in Africa remains very early and much of the sales occur on online marketplaces like Jumia. Most retailers have not yet launched their own ecommerce stores to sell directly to customers. Over time however this will happen and Flutterwave could become the logical provider for retailers on the continent to work with if it invests more in Flutterwave Store.

Lastly Flutterwave can pursue strategy three, expanding its suite of fintech services, to continue to grow. Stripe is a good example of this strategy in action. When Stripe started it was focused primarily on enabling online payments. Over time it has expanded its suite of services launching things like Stripe Connect (payments tools for online marketplaces), Stripe Issuing (online custom card creation) and Stripe Capital (fast, flexible debt financing for its customers). Flutterwave can follow a similar playbook with business financing being a particularly interesting opportunity for it given the in-depth data and understanding it has on its merchants revenues and cashflow. It can expand into salary advance services, receivables financing and many other adjacencies that can deepen its relationships with its customers and grow its revenue.

Flutterwave’s mission to digitize payments in Africa is just beginning and its presence across the continent is only going to grow with time. While Flutterwave is facing competition from numerous players the key question for it moving forward will be how to build a suite of services that make it a go-to for merchants and retailers on the continent and how to capture mindshare. Will Flutterwave versus Paystack/Stripe become one of the great startup battles in Africa? Time will tell.