Special Report: GoTo and the Super App Wars

This week the Super App Wars in Southeast Asia reached a new level of competitive intensity. The long-rumoured merger between Indonesian ecommerce retailer Tokopedia (which I wrote about earlier this year) and Indonesian ridesharing and delivery giant GoJek was finally publicly announced. The new combined entity, called GoTo, will be valued at $18 billion and combines the forces and resources of two of Indonesia’s biggest startups.

The merger of GoJek and Tokopedia will create one of the largest technology companies in the world:

Total Group Gross Transaction Value (GTV) of over $22 billion in 2020

Over 1.8 billion transactions in 2020

Total registered driver fleet of over two million as of December 2020

Over 11 million merchant partners as of December 2020

Over 100 million monthly active users (MAU)

An ecosystem that encompasses 2% of Indonesia’s GDP

The creation of GoTo will now kick off a showdown between Super Apps in Southeast Asia between GoTo, Grab and Sea in a battle for supremacy. With Grab’s recently announced SPAC deal giving it $4 billion in fresh financing, Sea’s deep financial resources and GoTo’s planned IPO later this year the stage is set for a bruising battle between all three to become Southeast Asia’s dominant Super App.

Grab, Sea and GoTo

The core thesis of Super App businesses - first pioneered in China by WeChat - is to aggregate consumer attention and demand in one application experience and use this to capture more and more of their discretionary spending over time. The rapid rise of rideshare startups over the last decade has become the beachhead for the creation of Super Apps across the world including Careem in the Middle East, Rappi in Latin America and Grab and Gojek in Southeast Asia. Over time these Super Apps have branched into delivering all kinds of goods including grocery delivery and medicine delivery and even services like massages and car cleaning crews.

Southeast Asia’s internet economy is a major global prize and has sparked an intense battle to become the dominant Super App in the region. The region’s 400 million internet users and rapid economic growth and soaring digital payments volumes have attracted numerous entrepreneurs and billions in venture capital financing.

Grab - which I wrote about earlier this year - has become emblematic of the rise of Super Apps worldwide. Grab started in 2012 as a ridesharing business with regional ambitions and quickly scaled from there. With the driver network from its ridesharing business as a base it expanded into food delivery, ecommerce delivery and grocery delivery. However Grab’s evolution into a Super App truly began when it launched GrabPay. GrabPay is Grab’s next act and its goal is not only to have consumers spend more and more of their income on Grab services every month, but also for Grab to own the financial tools that consumers use to live their day-to-day life. GrabPay enables customers to purchase products in-store via QR payments, send peer-to-peer transfers, apply for credit cards and even invest in stocks through the recently launched GrabInvest product.

Besides Grab, Sea is the other major technology company vying for supremacy in Southeast Asia. Unlike Grab and GoTo, which are both still private companies, Sea is a publicly traded giant with a market capitalization of over $120 billion. Sea’s business is unique compared to Grab and GoTo thanks to Garena, it's gaming division. Garena Free Fire is an immensely popular mobile game with 650 million quarterly active users and 80 million paying users per quarter. Importantly Garena is an incredibly profitable business and generated over 700 million in EBITDA off of $1.1 billion in bookings in just the first quarter of 2021.

Sea has used the profitability and free cashflow generated through Garena as a weapon in its quest to become the dominant technology company in Southeast Asia and the world. Sea launched Shopee, its ecommerce marketplace, in 2015. Shopee is very similar to Tokopedia and allows ecommerce merchants to sell on its platform and offers consumers a wide range of products to purchase.

Sea has used the proceeds from Garena to finance Shopee’s aggressive expansion into 7 countries in Southeast Asia as well as recently launching in Brazil and Mexico, a clear indication of Sea’s global ambitions. Shopee has rapidly risen to become the most visited ecommerce site in the region and in Q1 of 2021 it had a gross merchandise volume of $12.6 billion and revenues of $900m million. Shopee remains a highly unprofitable business and burned over $400m in cash in Q1 2021 alone. Without Garena, Sea would not have been able to launch Shopee in the way it did and grow it as aggressively over the past few years.

The third pillar and next act for Sea - much like Grab - is financial services. Sea launched SeaMoney in 2014 as a digital payments and financial services provider to businesses and individuals in the region. SeaMoney’s offerings include mobile wallet services, payment processing, credit and other financial services. SeaMoney - like all of Sea’s businesses - has reached significant scale and has 26 million quarterly paying users and processed $3.4 billion in Total Payment Volume in the first quarter of 2021.

The final contender in the battle to become Southeast Asia’s dominant Super App is GoTo. The combination of GoJek and Tokopedia is deeply strategic for both parties and enables them to pool their resources and compete against Grab and Sea for market share. In particular, GoJek’s payment product GoPay is of particular strategic value to Tokopedia. Shopee’s growth has been driven and enabled by SeaMoney, the digital wallet and payments tool owned by Shopee’s parent company Sea. Likewise, Tokopedia’s deep merchant network and market share of ecommerce are of strategic value to GoJek, helping maximize utilization of its logistics network and infrastructure.

The merger of the two companies creates a tech company that looks unlike any other company globally. The combination of Tokopedia’s ecommerce marketplace, fulfillment services and SMB retailer tools with GoJek’s 2 million delivery drivers, financial services arm GoPay and online streaming service GoPlay creates a company with an extensive range of capabilities. Few companies have deep logistics capabilities, consumer finance tools, a third-party ecommerce marketplace, online streaming services and food delivery services. Customers of GoTo will be able to meet their every need through the platform.

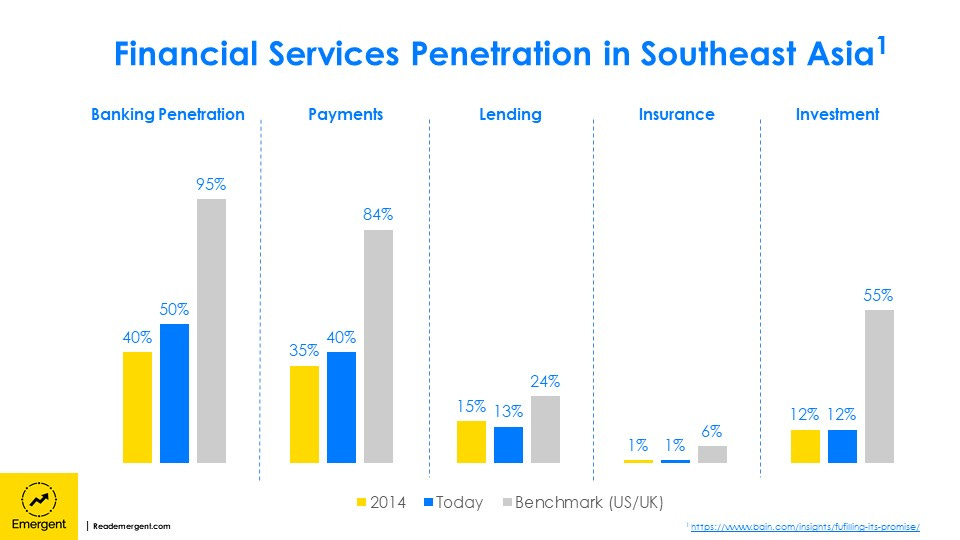

The most important battleground between GoTo, Grab and Sea is financial services. Penetration of financial services remains extremely low across Southeast Asia and has motivated all three companies to build products and services in the space. What started as digital wallets and payment tools is rapidly evolving into a full-on digital banking. In late 2020 both Grab and Sea were awarded digital banking licenses in Singapore and GoJek recently bought 22% of Bank Jago in Indonesia to deepen its financial services offerings. Grab Financial Group (a subsidiary of Grab) also recently raised $300 million in fresh financing to aggressively expand GrabPay in the region.

All three companies are marshalling their troops ahead of what is going to be a bruising battle for supremacy in Southeast Asia. Each of these three companies has its unique strengths. GoTo however, unlike Sea or Grab, is the the most vertically-integrated business and has the broadest product suite. This makes it the closest to a true Super App for Southeast Asia of all of them. GoTo must now successfully execute its merger and deepen its investments in GoPay to create a flywheel powering its entire ecosystem. Otherwise it risks squandering the opportunity to become Southeast Asia's dominant Super App, and making the merger a wasted effort.