Konfío: Lending to Mexico's 4.4m SMEs

Lending to Mexico's Credit-Starved SMEs

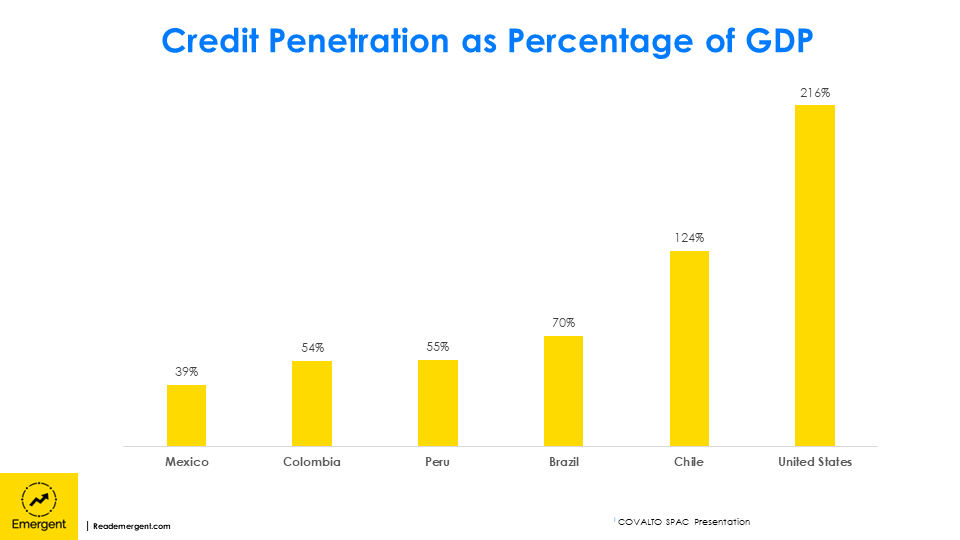

In Mexico SMEs are an integral part of the economy and are responsible for 88% of private sector employment. Despite this the economic contribution of SMEs is only 35% of Mexico’s GDP compared to 40-50% for other comparable economies. Their smaller share of GDP in Mexico is primarily the result of a lack of access to credit to finance growth. Poor access to credit is a universal problem across emerging markets and a major area of current innovation. Konfío was born to solve this very problem.

Headquartered in Mexico City, Konfío is a leading online lending platform offering affordable credit and payment tools to Mexico’s SMEs. The company was founded in 2013 by David Arana and Francisco Padilla and backed by investors like Quona Capital, IFC, VEF, Goldman Sachs, Softbank, and QED Investors.

Over the course of the past decade, the company has scaled impressively:

Raised $706 million in funding to date

Achieved a valuation of $1.3 billion

Extended 45,000 loans to more than 27,600 SMEs

Supported 70,000 businesses and SMEs throughout Mexico

Boosted SME clients growth by 25% year over year

Product

SMEs are usually underserved by traditional banks who fail to cater their credit or payments products to the unique needs and demands of an SME. Konfío offers Mexico’s SMEs a robust suite of credit and payment tools including:

Business Credit: SMEs can obtain multi-million dollar lines of credit through Konfío’s online portal without having to provide a guarantee.

Business Credit Card: The company offers business cards to easily pay expenses, reconcile invoices and define roles and permissions

Payments: Konfío offers a payment terminal for businesses to accept customer payments. It allows users to maximize their earnings and accept card payments with a commission from 1.35% to 3.5% + VAT.

Konfío has a straightforward business model. It generates interest revenue from its lines of credit and generates interchange revenue from its credit card products and point-of-sale terminals. Konfío charges steep rates on its line of credit and is currently charging an average annual percentage rate (APR) of 31.6%. For its Business Credit Card it charges an even steeper 67.4% APR.

Market

There are over 4.4 million MSMEs in Mexico that are underserved by the traditional banking system due to their size, informal nature, lack of credit history or the lack of ability to meet profitability requirements. While SMEs account for 99% of businesses in Mexico, they represent only 9.1% of all the loans disbursed. This is equivalent to just 3.7% of the Mexican GDP, compared to the 7 - 10% SME loan disbursement in other economies of Latin America.

It can take up to two years for an SME to secure a loan from a traditional bank in Mexico. Alternatively, informal lenders are also a source of credit but often charge exorbitant rates of 100% or more. Thus, SMEs are starved for credit in Mexico and the SME loan market has the potential to expand by 2.4x, growing from its current size of $43 Billion to over $100 Billion (nearly 9% of GDP) over the next few years.

Competition

Konfío faces competition from a number of fintech players across Latin America including the likes of Covalto, Kapital, Creze and Kueski.

Covalto (formerly known as Credijusto) is a Mexican digital bank that offers bank accounts, lines of credits, factoring and other financial products to SMEs. The company was founded in 2015 by Allan Apoj and David Poritz, and is headquartered in Mexico City. The company originated over $350 million in loans by the end of 2022 with estimated 2022 revenue of $64.5 Million. The company recently delayed its planned SPAC merger to 2024. This merger will give Covalto a pro-forma valuation of $547 million.

Kapital is a Mexican fintech company offering a rich set of financial products to SMEs in Mexico. The company offers business cards, revolving credit lines, collections tools and business loans. The company was founded in 2020 and has raised over $200 million in debt and equity financing to date. The company was founded by Rene Saul, Fernando Sandoval Oseguera and Eder Echeverria

Creze is a Mexican fintech company that offers credit products and services to SMEs. Creze uses machine learning to efficiently analyze credit risk and provide quick loan decisions with funds transferred within 3 business days. It offers unsecured loans to Mexican SMEs wanting to fuel their growth and improve their working capital management. The company was founded by David Lask and Bernardo Prum in 2015, is headquartered in Mexico City and has raised $17 million to date.

Kueski is a Mexican fintech company that provides short-term loans to individuals. Unlike Konfío, Kueski does not have a specific focus on SMEs and instead lends only to consumers. However its product suite is similar to Konfío’s and it is one of the largest online consumer lending companies in Latin America. The company was founded in 2012 by Adalberto Flores and Leonardo de la Cerda and is headquartered in Guadalajara, Mexico. Kueski has raised over $323 million in equity and debt funding. The company has around 1.8 million customers and has disbursed over 10 million loans to date.

Growth Opportunities

Konfío has built a strong market position since its founding and a deep bench of customers. However, the Mexican SME market remains underbanked and underlent to, with significant room for further growth.

Konfío has several possible growth paths ahead of it including:

Expanding into digital banking services

Expanding into consumer lending

Geographic expansion

In Mexico, only 45% of SMEs have access to the traditional financial system and are severely underserved by banks. The opportunity to offer banking services to SMEs is significant. Konfío’s primary competitor Covalto initially started as a SME lending business. However, in 2021 the company launched a major expansion of its platform by becoming the first Mexican fintech to acquire a bank when it acquired Banco Finterra.

Acquiring a bank and its banking license massively increases the diversity and sophistication of products that Covalto could offer to SMEs. Covalto now offers digital business accounts to its customers alongside a suite of lending products. Covalto also offers consumer accounts. Offering digital banking services through a partnership with an existing bank or acquiring a smaller bank is a logical expansion for Konfío to allow it to continue to compete with Covalto and diversify its revenue streams. Lending is a strong hook to acquire an SME and onboard them into a wider digital banking ecosystem.

Acquiring a banking license can also give Konfío regulatory cover for a second expansion into consumer banking and lending. Mexico remains a highly unbanked market with 57% of men and 43.9% women reporting having a bank account. Penetration of consumer lending products is substantially lower than that. Konfío has built much of the digital infrastructure, credit facilities and underwriting technology to enable an expansion into consumer lending. It will have to redesign and optimize its technology for the consumer lending context and dataset. However, the owners of its SMEs and their employees and families are a natural set of customers to onboard onto a consumer lending and banking product.

Lastly, geographic expansion is likely on the roadmap for Konfío in several years. While Mexico’s SMEs are particularly credit-starved, SMEs across Latin America face many of the same challenges accessing digital financial services and credit. However, geographic expansion will open Konfío up to a wider range of well capitalized competitors, especially in Brazil. Similarly, there is limited synergy with its Mexican business and any other potential geographies. The dataset it builds up in Mexico, the customer profiles and other insights will be unique to Mexico and unlikely to help underwrite customers in new geographies.

Overall, Konfío is a success story for SME lending in LATAM and globally. The company has helped pioneer a category that has inspired numerous entrepreneurs globally to build similar products in different markets. Access to credit is a key driver of economic growth. Consumer access to credit drives higher consumer spending (mortgages, student loans and BNPL). Business access to credit drives higher investment, R&D and expansion.

Poor credit access is one of the biggest bottlenecks holding back economic growth around the world, preventing developing economies becoming middle income and then wealthy countries. In March 2023 Konfío expanded its credit line to $227 million. Konfío is on a mission to close the credit gap for SMEs in Mexico and it has only just scratched the surface of its tremendous market opportunity. Watch this space!