Jumia: Amazon of Africa?

The Rise of Ecommerce in Africa

Intro Note

Welcome to Emergent! Thank you for joining this journey with me, you are one of the first 100 subscribers.

My name is Mikal – I’m an early-stage tech investor and I was born in Asia, grew up in Africa and now live in the US. Every week I break down a fast-growing business in an emerging market to understand its product, market and growth strategy.

Today I'm breaking down Jumia.

Overview

2020 was an explosive year for ecommerce globally, with ecommerce businesses seeing their revenues soar, profits increase and valuations climb. One of the biggest beneficiaries of this trend was Jumia, which saw its valuation soar from lows of ~$2.50 in March of 2020 to highs of $65 recently.

Jumia is Africa’s leading ecommerce company connecting merchants and buyers together in 11 countries. Modeled after Amazon, customers of Jumia can buy a broad range of products on the site, everything from electronics to makeup. In addition, Jumia helps facilitate these transactions with a range of payment and fulfillment tools for its users and merchants. Today, Jumia is in the lead to become the “Amazon of Africa.” Will it squander its lead, or embrace it?

Jumia was founded by German technology holding company Rocket Internet with the goal of being the Amazon of Africa. To this day Jumia remains headquartered in Berlin, despite operating its business only in African markets. This has opened Jumia up to criticisms that it is a “neo-colonial” startup, built in Europe to take advantage of the growth of the African market.

Founded in 2012, Jumia has grown to tremendous scale in just 8 years:

110,000 sellers on the platform

6.8 million annual active customers

Generating around $1 billion in gross merchandise value annually

Market cap of ~$4 Billion

Jumia’s rapid growth has come despite how early ecommerce still is in Africa. Over time however, as ecommerce adoption rises in Africa, Jumia’s growth rate is likely to accelerate dramatically.

It's no secret that Africa is the next frontier for the global economy:

Africa’s population will nearly double from 1.3 billion today to 2.4 billion by 2050

The continent has over 500m users with access to mobile internet coverage

Its economy is set to grow 3-5% consistently over the next decades

Today Jumia operates in 11 African countries who account for the bulk of the continent's GDP and population, particularly Nigeria, Egypt and South Africa.

Products

Jumia is a highly diversified business and offers a range of different products to consumers. Jumia’s business has five core pillars:

Third-party Marketplace: Connecting merchants and buyers together for ecommerce transactions

JumiaPay: A digital payments service for Jumia users

Jumia Food Delivery: Connecting restaurants and buyers together and facilitates delivery

Jumia Logistics: A fulfillment business for it's retailers, modeled off Amazon Fulfillment Services

Jumia Gaming: Launched in Q3 2020 with 500 different mobile games available today

At the core of the company is its third-party marketplace which connects ecommerce sellers with buyers across the continent. Its marketplace sells everything from baby products to car tyres and mobile phones. Impressively, Jumia has over 40 million listed products on its marketplace today!

Historically, a large part of the Jumia marketplace has been driven by Jumia selling mobile phones and electronics to consumers on a first-party basis (where they serve as the seller, as opposed to a third-party). However, over the past year it has steadily been transitioning towards a more third-party focused marketplace in an effort to become a “pure” marketplace. Third-party sales as a whole offer better margins to ecommerce companies than first-party sales.

Jumia is not the first ecommerce marketplace to realize third-party sales are a more powerful growth engine than first-party sales. Amazon has put significant effort and resources into growing its third-party gross merchandise value (GMV) - the total value of the goods sold through the platform. Today, analysts estimate that Amazon has $490 billion in GMV, of which $300 billion is third-party sales. More importantly, the growth rate of Amazon’s third-party marketplace exceeds its first-party Amazon Retail business, growing 50% in 2020 vs 40% for Amazon Retail. Third-party sales now account for 62% of Amazon’s total GMV, up from 57% in 2018.

Data from Marketplace Pulse

Jumia’s transition towards a more third-party focused marketplace saw sales in Q3 2020 in its first-party revenue business drop by 53%. This transition caused its GMV to drop from $314m in Q3 2019 to $225m in Q3 2020. However, Jumia is successfully repositioning its marketplace to be more third-party focused which is helping improve its unit economics. In Q4 of 2020, Jumia’s GMV accelerated to $280m, a 23% quarter-on-quarter acceleration, powered in part by Jumia’s Black Friday events and campaigns.

Slide from Jumia Q3 Earnings Report

Aside from its third-party marketplace, JumiaPay is the most important piece of Jumia’s business. Consumers can do a broad range of things with JumiaPay including get cashback on different purchases, pay utility bills, make hotel reservations, pay their phone bill and get loans from Jumia directly. JumiaPay is modeled after the likes of M-Pesa, AliPay, Paytm and KakaoPay in Asia.

Excitingly for the company, JumiaPay had a breakout year in 2020. It grew rapidly in 2020 with a 58% increase in year-on-year payment volume. The growth of JumiaPay is being driven by its evolution into a “SuperApp.” Overall an impressive 35% of transactions on Jumia in 2020 were paid for via JumiaPay.

The growth of JumiaPay is being driven by its evolution into a “SuperApp.” In 2020, Jumia added over 111 different services onto the JumiaPay app, from paying for your telephone bills to online sports betting. Today, JumiaPay is live in 8 markets: Nigeria, Egypt, Morocco, Ivory Coast, Ghana, Kenya, Tunisia and Uganda.

Slide from Jumia Q4 Earnings Report

Competitors

While Jumia has established an early lead and broad presence across the continent, it is facing stiff competition from other startups.

Souq - owned by Amazon - is leading in the Egyptian market

Jiji - with over 8 million monthly active users, Jiji is a strong competitor in Nigeria

Konga - has been an war with Jumia for years in a battle to dominate the Nigerian ecommece market. The company is considering an IPO soon.

Takealot - South Africa's leading ecommece site with about 2m customers, but currently operates only in South Africa.

Kilimall - founded by a ex-Huawei employee, allows Chinese as well as local merchants to sell directly into Africa and currently operates in Kenya, Uganda and Nigeria.

Jumia’s largest advantages over most of these competitors is its cheaper cost of capital - by virtue of being public - and the number of markets it operates in. Most of these competitors operate in 1 or 2 countries as opposed to Jumia’s 11 and are constrained by the local growth and dynamics in their markets whereas Jumia can take advantage of the growth of a range of different markets. In addition, most of these competitors don’t have a competing product to JumiaPay - a critical lubricant for sales on the platform.

Unlike Jumia however, these competitors were all founded by entrepreneurs in local markets, as opposed to Jumia which was founded in Europe. So far, this has not offered a noticeable advantage to these competitors. But, that may change over time if Jumia’s product innovation doesn’t continue to meet local market needs as effectively as these competitors might.

Growth Opportunities

Jumia's leadership are focused and have made hard choices in the pursuit of profitability including:

Shutting down operations in 3 countries

Shutting down it's hotel booking engine Jumia Travel

Cuttings administrative costs

This has started to pay off, its gross profit after fulfillment expenses has risen from -$18.6m in Q3 2019 to $0.48m in Q3 2020. By Q4 of 2020, Jumia saw its gross profit after fulfillment spike to $10 million, indicating that Jumia’s focus on improving its unit economics and pursuing profitability is gaining momentum.

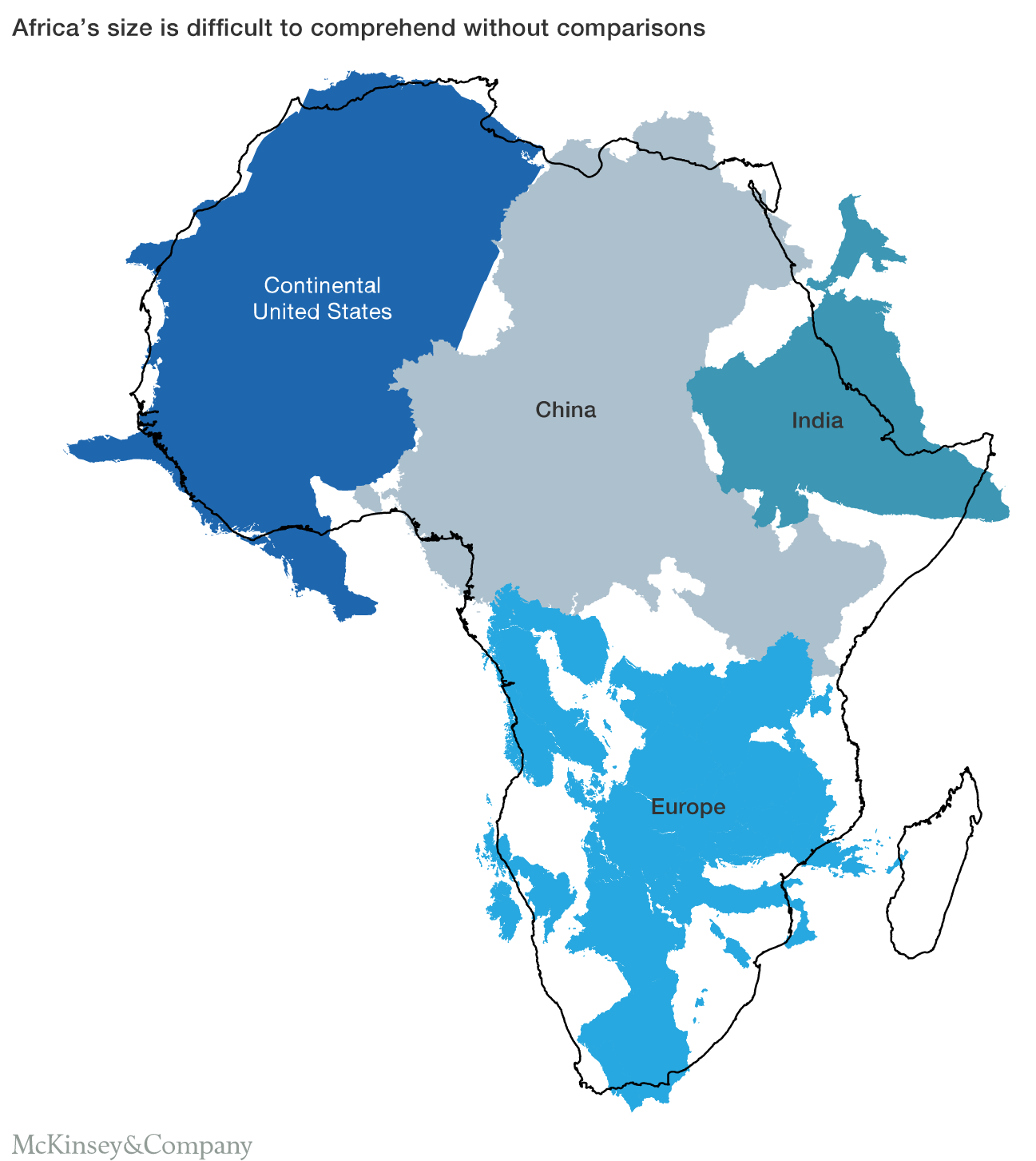

Ultimately, the immense logistical challenges of serving the entire African market may constrain Jumia to the largest and most lucrative markets it operates in over the long-term. For ecommerce businesses in Africa, serving high density urban areas will always be far simpler than serving more distributed and distant population centers across the gigantic continent.

These logistical challenges - without further innovation in drone and driverless delivery - may make the unit economics of serving the entire African continent unattractive for Jumia. This opens the door to other ecommerce marketplaces across the continent to be built, serving customers in different regions and across different niches successfully.

Where Jumia has a significant opportunity to establish an unassailable lead is with JumiaPay. If Jumia can turn the Pay product into a SuperApp like Wechat or Meituan in China, it will be able to expand into every country in Africa, partnering with local providers of food delivery, ecommerce and more. JumiaPay could position Jumia to become a gatekeeper for a large segment of digital commerce across the African continent, in much the same way Paypal did in the early days of ecommerce.

Ultimately however, there may be multiple regionalized “Amazons of Africa” - with Jumia being the first but not the last.