Freshworks: The King of Global SMB SAAS

Enterprise software companies serving large corporate customers has long dominated the world of venture capital and startups as the category that most excites investors, attracts numerous great entrepreneurs and consistently produces large companies. However, over the last decade as the tech industry has evolved from a vertical into a horizontal industry - penetrating an ever broader range of industries – entrepreneurs are increasingly launching companies that build software for small and medium businesses (SMBs).

Companies such as Quickbooks, Square, Toast, Shopify and numerous others are putting powerful software tools in the hands of SMBs and helping them reduce their costs and maximize their revenue. Many of these startups are US-centric and have not yet expanded outside North America in a major way.

One major exception to this rule is Indian SAAS giant Freshworks which recently went public on the NYSE and has a hefty $13 billion market cap today. Freshworks is a shining example of a world-leading software company and a global champion founded and built in an emerging market.

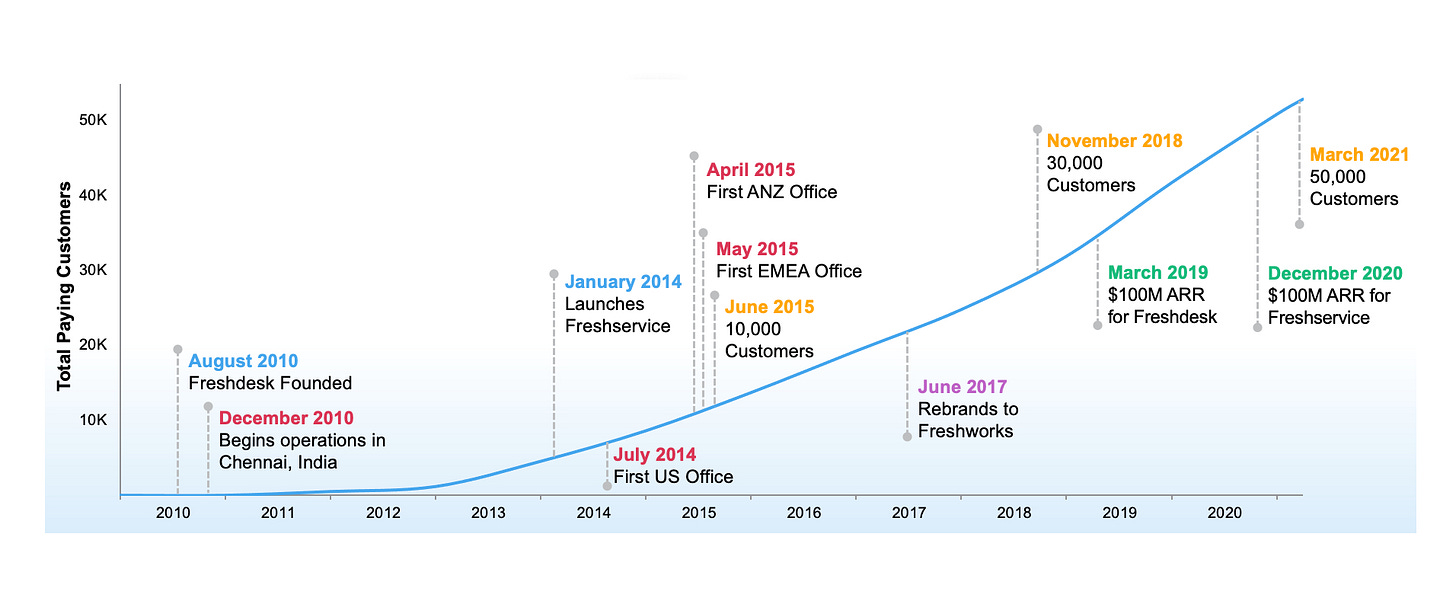

Freshworks has achieved significant scale since its founding in 2010:

52,000 customers across 120 countries

$308 million in Last Twelve Months (LTM) revenue

Freshworks and Freshservice are both $100 million revenue run rate SAAS products in their own right

$484 million raised prior to IPO

Products

Over the past 11 years Freshworks has built a range of deeply interconnected and synergistic products across sales, marketing and customer service to give SMBs many of the tools and capabilities of large corporations. Freshworks core products are:

FreshSales: A powerful and flexible CRM platform to power SMB sales teams

FreshDesk: Customer support, messaging and call center tools

FreshMarketer: A marketing automation cloud enabling personalized marketing to different customers

FreshService: IT service management software

FreshTeam: HR software to manage hiring, onboarding and time-off

Freshworks Neo: A suite of AI tools that supercharge all of Freshworks core products

Freshworks Marketplace: A marketplace of third-party apps that extend the functionality of the core Freshworks products

According to their recent S-1 filing the core values driving Freshworks product ethos are transparent pricing, extensibility and customizability, user productivity and tangible ROI. The company’s different products are very affordable compared to other software companies with pricing starting as little as $0 per month and reaching $299 on the high end.

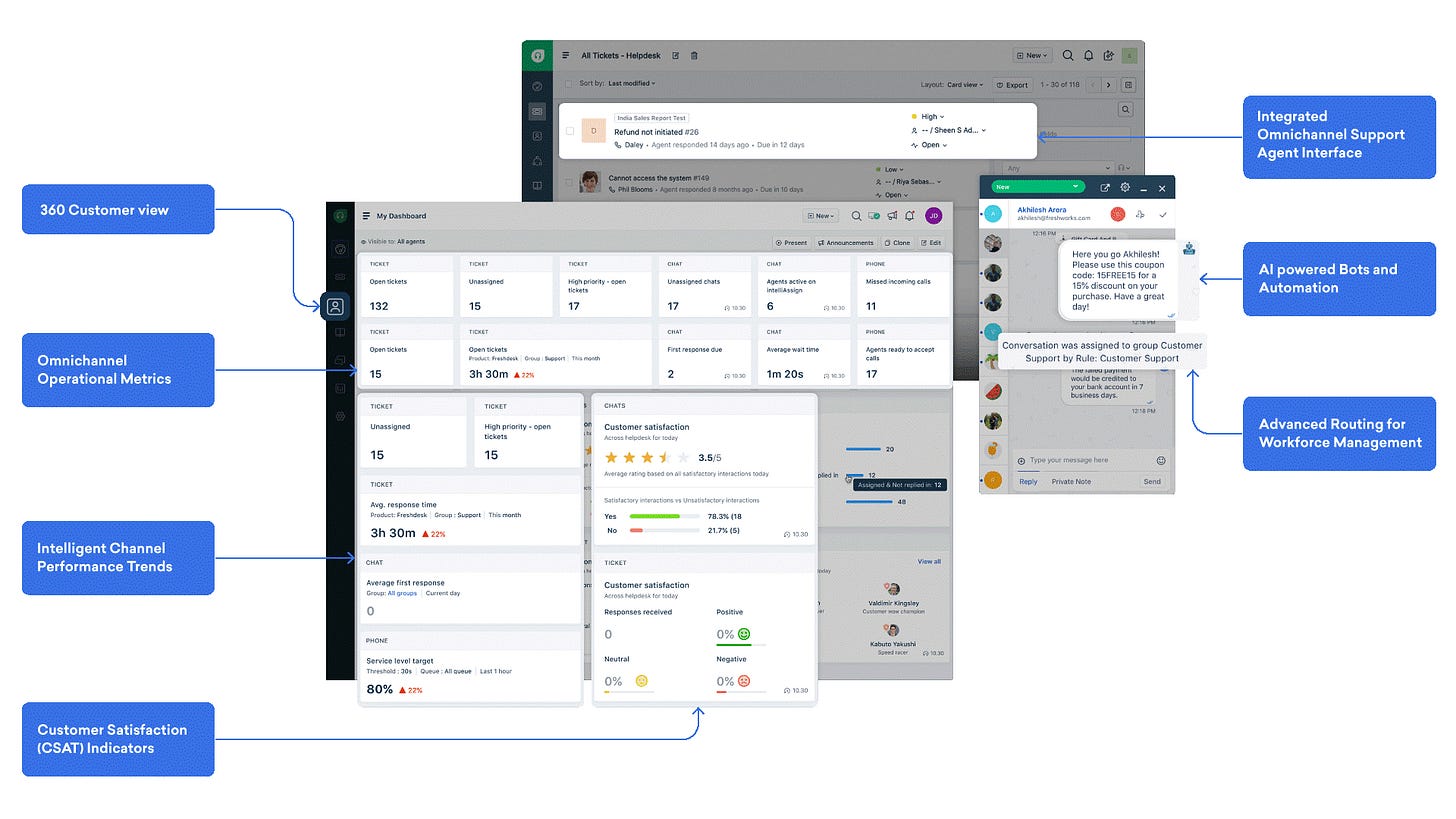

FreshDesk and FreshSales are the company’s flagship SAAS products today and both generate over $100 million in annual revenue per year. FreshSales is a CRM product – similar to Salesforce or Hubspot – targeted to SMBs and is the core of the company’s platform. FreshSales has all the typical features of a CRM - deal management, email integrations, contact management and more.

On top of this core CRM Freshworks has built a range of complementary products that empower SMBs to service customers throughout their lifecycle including FreshDesk - a suite of customer support tools - and FreshMarketer - a marketing automation cloud - as well as a few free products such as Freshping and Freshstatus.

In recent years Freshworks has expanded into building internal-facing software tools for its customers such as FreshTeam, an HR software product to help HR teams manage company employees and HR functions and FreshService - software for IT teams to manage internal systems.

Freshworks has wrapped a layer of intelligence around these different products it calls Freshworks Neo. The Neo product is designed to turn the significant data captured by Freshworks' different products and turn it into actionable insights. The Neo product’s core offering is Freddy AI, a cloud-based AI product.

Finally, following a strategy pioneered by some of the earliest enterprise software giants such as Salesforce, Freshworks launched Freshworks marketplace where third-party developers can build and launch apps that help extend the functionality of the Freshworks platform. Today, the marketplace has over 1000 different apps that expand the functionality of all Freshworks products.

Customers and Market

Freshworks' impressive $308 million in LTM revenue and $250 million in 2020 revenue was generated by a large and highly diversified customer base. What is most striking about Freshworks is the lack of concentration in its customer base. The company has over 52,000 customers and yet only 1,164 of those customers pay more than $50,000 a year to the company. In fact, Freshworks top 10 customers account for less than 5% of its annual revenue. These metrics help illustrate that Freshworks truly is an SMB SAAS company.

Even more impressively, Freshworks customer base is highly global and not concentrated in India or the United States. In 2020, Freshworks generated less than 50% of its revenue from North America, the largest software market in the world.

Freshworks claims that it is targeting a $120 billion global software market. This number is not overly aspirational as estimates of the global CRM market forecast it to hit $95 billion by 2027 and and the global marketing technology (martech) market is estimated to be worth $120 billion in 2020. These are just two of the product categories Freshworks plays in. The reality is that year after year the market for software products globally has proven to be far deeper and far larger than even the most optimistic of investors and entrepreneurs expected. Freshworks has a lot of room to grow globally in the years to come.

Growth Opportunities

Despite Freshworks’ impressive achievements, the company is still in the early phases of achieving its full potential. The company has several possible levers it can pull for growth including:

Double down on non-Western markets

Move into the enterprise segment

Deepen its marketing cloud

Freshworks has been pursuing strategy one since the founding of the company. In fact, its first customer came from Australia and its first few customers came from four different continents. It’s clear that the company sees significant growth potential from non-Western markets. Fortunately the pricing of its product ($0-$299 / month) and its integrations with popular business tools in emerging markets such as Whatsapp position it far better than any other CRM and customer support software company to be the go-to CRM for SMBs across Asia, Africa and Latin America. Much of Freshworks growth has been organic, with customers finding its products, testing them out and then converting into paying customers all on their own right – the “bottoms up” SAAS playbook.

Beyond further investment in these markets, the company can grow its revenue significantly if it expands into the enterprise segment. The enterprise market for CRM software is huge, with Salesforce alone generating over $17 billion in revenue, the majority from large corporate customers. Freshworks has the opportunity to be the market leader in the enterprise CRM segment in non-Western markets if it continues to invest in building an enterprise-grade version of the Freshworks platform.

In a recent interview with CNBC Freshworsk CEO Girish Mathrubootham noted that Freshworks platform has consumer-grade UX/UI but enterprise-grade tech thanks to investments made in the last five years. Today the company has 1,500 enteprise customers, a small share of its total customer base. However, there are numerous corporations across Africa, LATAM and Asia that don’t use CRM, Customer Support or marketing software or use very antiquated tools. There is a huge opportunity here for Freshworks to capitalize on given its brand, existing customer base and global focus.

Finally, Freshworks can grow its average contract value (ACV) by deepening its marketing cloud. The FreshMarketer product line is quite limited today compared to other leading marketing automation clouds such as Mailchimp, Salesforce Marketing Cloud and more. The martech industry is a highly fragmented one with over 7,000 tools competing for market share globally today. However, Freshworks' bottoms-up go-to-market model that has powered its growth so far will enable it to affordably acquire customers and upsell them over time into a deeper marketing cloud.

Overall, Freshworks is a shining example of a world-leading and global software company founded and built in an emerging market. Its IPO is a tipping point for entrepreneurs in much of the world who aspire to build large SAAS businesses. Historically investors have doubted whether large SAAS businesses can be built outside the US. Freshworks has decisively answered that question. Now the doors are opening to dozens of SAAS companies to be built of similar scale across the world. The best thing Freshworks can do is to continue to serve as a role model and inspiration for these companies by continuing to grow rapidly.