Abhi: Pakistan's Lending Powerhouse

Early Wage Access and the challenges and opportunities of lending in an emerging market

Happy new year and welcome to the first edition of Emergent for 2024. To kick off the year I’ve teamed up with my friend Patrick Alex at Endeavor for a special double episode on Pakistani fintech startup Abhi.

Pat is the host of the Enthusiast podcast where he interviews founders of some of the most exciting emerging markets startups. Pat and I sat down with Abhi CEO Omair Ansari a few weeks ago to learn about the founding story of Abhi. Check out the full episode in the link below!

On top of the podcast episode we also put together a full-length breakdown of Abhi’s business model and market opportunity below. Check it out!

[Disclosure: I’m an angel investor in Abhi so I definitely have a favorable view of everything they are doing.]

Abhi Overview

Financial services is one of the largest and most important industries globally. While many financial institutions are decades (and even hundreds) of years old, in recent years the industry has been undergoing a technological renaissance thanks to the rise of the fintech industry. Globally the fintech industry is now worth over $179 billion and there are over 30,000 fintech startups operating today.

While every country has a financial services industry, there are stark differences in the depth and sophistication of the industry between countries. In fact, more advanced economies have far more sophisticated and deep financial markets than do emerging economies. This stark gap has inspired numerous entrepreneurs in emerging markets to launch fintech businesses. One of the most exciting global fintech companies today is Pakistani startup Abhi (disclosure: I'm an investor in the company).

Abhi is a fintech company that financially empowers business and employees by providing a suite of lending products including Earned Wage Access, Invoice Factoring and Payroll Solutions.

Since its founding in 2021 Abhi has:

Raised $42+ million in debt and equity financing

Achieved a valuation of $90 million

Launched in Pakistan, Bangladesh and the UAE

Has over 450+ businesses using its platform

Has over 800,000 employees active on its platform

Became the first company in the MENAP region to issue Islamic Bonds via a $7.1 million Sukuk Issuance

Product

In a little over two years Abhi has built a comprehensive suite of lending products for businesses and employees. Abhi initially launched as a salary advance or “early wage access” platform. Abhi’s product suite includes:

Abhisalary: Abhi’s early wage access product for employees to advance their salary

Abhipayroll: A payroll management portal for employers as well as a payroll financing product

Abhifactoring: A factoring solution for businesses looking to borrow against their future receivables

Abhipay: A suite of payment tools to enable businesses to accept and manage online payments

Abhicod Financing: A partnership with one of Pakistan’s biggest logistics companies BlueEx to enable cash-on-delivery financing

Across emerging markets consumers struggle to access credit. In response a common workaround has emerged where employees ask their employers for salary advances. Often these salary advances are used to cover unexpected emergency expenses or to put downpayments on school fees, rents or for expensive items such as cars.

Typically this entire workflow is manual and inefficient. Over the last few years a number of startups have been founded globally who aim to digitize this manual process and make the management of salary advances a seamless process for both the employee and employer. Some of the most successful companies in this category include Payactive, DailyPay and Wagestream.

Abhisalary is a mobile app that enables employees to advance their accrued salary with no questions asked at any time. Employees receive a transfer for their accrued salary within 30 seconds and are charged a fixed fee of 100 Pakistani Rupees (about $0.35) per transfer. On the backend Abhi reconciles the flow of funds with the employer.

While Abhi started as an early wage access platform after deploying with its first few customers it immediately realized that lack of access to credit was not just a problem for the employees. Access to business credit is exceedingly hard to come by in most emerging markets and makes it hard to operate and grow a business. In fact, Pakistan has the second lowest credit-to-GDP ratio in the region of 15%.

This led Abhi to launch a range of lending products for businesses in Pakistan including Abhifactoring, Abhicod financing and Abhi’s payroll financing solution. These products all offer different kinds of working capital to businesses depending on their operating structure and needs.

Finally, Abhi launched Abhipay in partnership with Payriff offering a suite of tools to businesses to easily accept online payments. Inserting itself into the flow of funds has a strategic benefit to Abhi because it offers it a richer dataset to use to underwrite a business with, as well as an additional source of revenue.

Market

Lack of access to credit for consumers and businesses is one of the most significant bottlenecks to accelerating economic growth in emerging markets. Given Pakistan is the fifth largest country in the world, the domestic credit-to-GDP ratio of about 15% is extremely low compared to its neighbors. Only Nigeria (with a population of 215 million) has a similarly low rate of 12.9%. In contrast the US has a ratio of 216% and the United Kingdom has a ratio of 130%.

Raising the credit-to-GDP ratio will have transformative effects for Pakistan’s economy and is an enormous multibillion dollar opportunity. For consumers the first and easiest method for access to credit typically in advanced economies are credit cards. However Pakistan’s domestic credit card market is extremely underdeveloped and of the 48 million payment cards in circulation only 1.9 million of them are credit cards. The room for growth here is enormous, however this isn’t the problem that Abhi is dedicated to solving (at the moment at least).

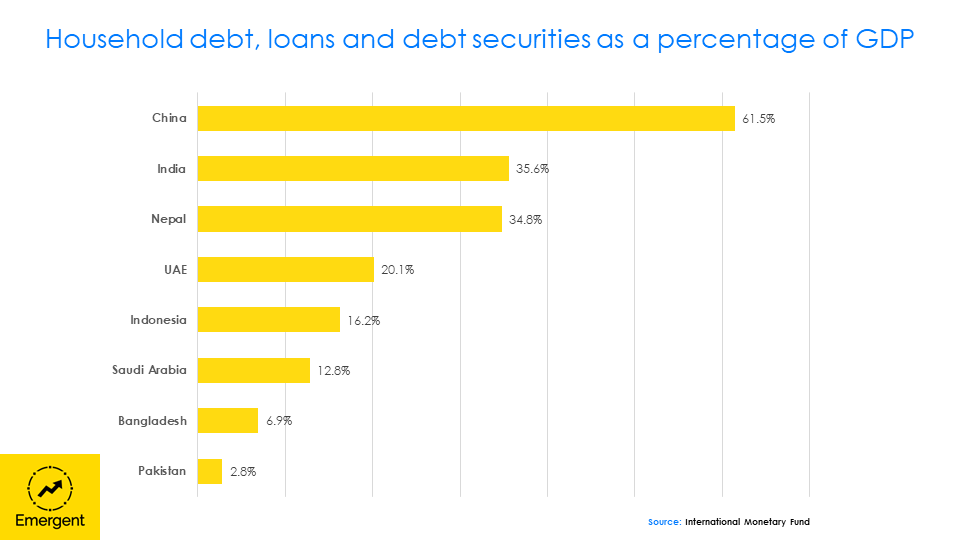

In fact Pakistan has one of the lowest rates of household debt in the world at just 2.8% of GDP. In contrast, Indonesia - the world’s largest Muslim country - sits at 16.2% and India at 35.6%. The lack of access to debt seriously hamstrings consumer spending in Pakistan. Increasing access to credit for consumers is an enormous opportunity for Pakistan’s economy.

Competition

In Pakistan Abhi faces several indirect competitors that compete with different elements of its product offering and some more direct competitors in its third market, the UAE. These competitors include AdalFi, EduFi, Neem Finance, Beehive and existing banks.

AdalFi is a Pakistani fintech that offers a range of software and data products to banks in Pakistan that enable them to quickly and efficiently underwrite consumers and SMEs for loans. Today it works with 14 banks in Pakistan and enables them to underwrite consumers for credit cards and salary advances and underwrite businesses for term loans and credit lines. AdalFi doesn’t lend directly to consumers or businesses off its balance sheet and instead empowers banks with the tools to lend more effectively. These partnerships equip banks with the technology to compete directly with Abhi to lend to these segments.

EduFi is a Pakistani fintech offering a “study now pay later” product to parents and students. This is a first of its kind product in the Pakistani market and is focused on one of the most significant areas of consumer spending in Pakistan. EduFi lends to students while offering schools the opportunity to receive their tuition revenues upfront for the year, improving their cashflows.

Beehive is a UAE-based fintech startup that offers a range of lending products to SMEs in the UAE. These products include working capital financing, term finance, revenue-based financing and more. Beehive was founded in 2014 and this year saw e& Enterprise purchase a majority 63.3% stake in the company for $23.6 million.

Invoice Bazaar is another UAE-based fintech that offers a suite of supply chain financing solutions for restaurants, ecommerce sellers and more. The company was founded in 2016, raised $6.1 million of financing and was recently acquired by Triterras (OTCMKTS: TRIRF) for $8 million.

Growth Opportunities

In the last two years Abhi has built a robust platform for lending to businesses and consumers and managed to launch in three countries in the region. Aside from signing more businesses and consumers up for their platform, Abhi has two additional possible growth paths ahead of it:

Regional expansion

Expanding its suite of consumer lending products

Abhi has already kicked off its regional expansion with its launch in the UAE as well as via its Bangladesh subsidiary Mitro. Across the region credit access is still a massive unsolved problem and the technology stack Abhi has built in Pakistan can easily be exported to new markets. Launching in a new market requires complying with local regulation and typically finding sources of local debt capital to fuel further growth. Two potential markets to expand to in the region for Abhi are Saudi Arabia and Iraq.

The Kingdom of Saudi Arabia through its Vision 2030 program has set an ambitious goal of becoming the main fintech hub for the MENAP region. So far, there are early signs of progress towards this goal. The number of fintech startups in the country has grown from 51 in 2021 to 200+ this year with a goal of 525 by 2030. With a GDP of $833 billion and a population of 32 million (with 63% under the age of 30) the Kingdom is a large and attractive expansion market. The Kingdom is also home to over 2.6 million Pakistanis. The linkages between Pakistan and the Kingdom go back decades and are an exciting sales vector to enter the country. The Kingdom is also home to over 6 million migrant workers, many of whom work in blue-collar jobs where a salary advance product is an appealing proposition.

Iraq is another appealing potential expansion market for Abhi. The country’s $207B GDP and 43 million people would significantly expand Abhi’s addressable market. Similarly Iraq also has a low rate of credit to the private sector (as a percentage of GDP) of 11.3%. This leaves ample room to grow business lending as well as consumer lending.

Aside from launching in new geographies Abhi can also launch new consumer lending products. The opportunities in consumer lending are vast and include mortgages, car loans, education loans and more. Thanks to its early wage access product Abhi has a rich and unique dataset that most banks don’t have access to – salary history. Over time Abhi will have a better view into an employee’s finances than any third-party lender. Abhi can use this data to offer consumers its own lending products or to partner with other lenders (such as EduFi) to offer their products on the Abhi platform.

Overall Abhi has built a leading position in Pakistan as a source of business and consumer lending. The opportunity in Pakistan alone is a multi-billion dollar opportunity. Abhi has also built a suite of products to meet the needs of consumers and businesses. However, the company’s technology stack and lending approach can be easily repurposed and launched into new markets in the region as it scales. Similarly, the company has only scratched the surface of consumer lending. Abhi’s growth path will be a barometer for fintech in the region more broadly.